Large international companies often do not send their profits directly from one country to another. Instead, they send it via other countries, so-called conduit countries, to reduce the tax they pay. Which countries are the most important conduit countries?

To investigate this, the CPB (Netherlands Bureau for Economic Policy Analysis) has collected and has analyzed data about tax streams worldwide ![[2]](https://www.networkpages.nl/wp-content/plugins/latex/cache/tex_beb4dbf9af069aa2df7b147229965085.gif) . In

. In ![[1]](https://www.networkpages.nl/wp-content/plugins/latex/cache/tex_35dba5d75538a9bbe0b4da4422759a0e.gif) , algorithms were implemented (and discussed from a mathematical point of view) that help to analyze this data, leading to some extra conclusions. In this article we describe some methods that have been used, and the results that this led to. How important is The Netherlands as a conduit country?

, algorithms were implemented (and discussed from a mathematical point of view) that help to analyze this data, leading to some extra conclusions. In this article we describe some methods that have been used, and the results that this led to. How important is The Netherlands as a conduit country?

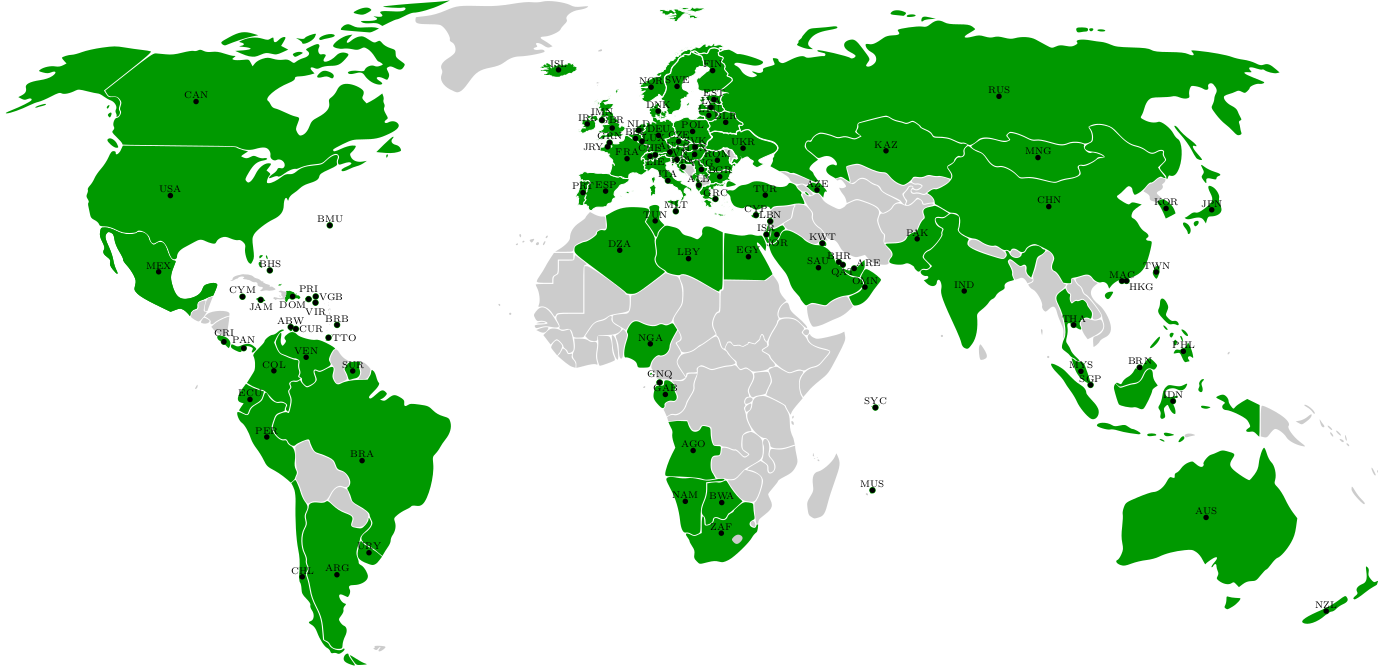

The dataset of the CPB consists of  countries/jurisdictions, and the tax rates that a company must pay when sending money from one country to another. The countries in the data set are colored green in the figure below.

countries/jurisdictions, and the tax rates that a company must pay when sending money from one country to another. The countries in the data set are colored green in the figure below.

In order to model how these taxes are paid by companies, we use a graph  where the set

where the set  contains the

contains the  countries from the dataset, and the set

countries from the dataset, and the set  contains arcs of the form

contains arcs of the form  which indicate that a company can send money from country

which indicate that a company can send money from country  to country

to country  . Suppose that a company wants to send a profit from country

. Suppose that a company wants to send a profit from country  , the United States of America, to country

, the United States of America, to country  , The Netherlands. The company might have to pay some tax to do this, because of bilateral tax treaties between the two countries. We write

, The Netherlands. The company might have to pay some tax to do this, because of bilateral tax treaties between the two countries. We write  for the tax percentage that the company must pay if it sends its profits directly from country

for the tax percentage that the company must pay if it sends its profits directly from country  to

to  . This means that the fraction of profit that a company has left after this transfer, can be written as

. This means that the fraction of profit that a company has left after this transfer, can be written as

As an example, suppose that a company wants to transfer one million dollars from the United States of America to The Netherlands, and that it has to pay 10% of taxes. This means that afterwards the company has  dollars left.

dollars left.

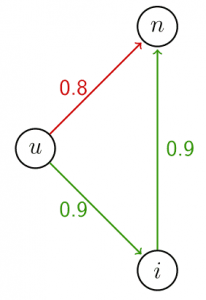

Why are conduit countries so important? In order to understand this, we will look at a small example. Suppose a company wants to return its profits from the USA to India, and that there is a bilateral tax agreement, in which it has been agreed that the company has to pay 20% of taxes over its profits that it wants to send from the USA to India. This means that  where the parameter

where the parameter  represents the USA, and the parameter

represents the USA, and the parameter  India. Now suppose that the Netherlands has bilateral tax agreements with both the USA and India, and that 10% of taxes has to be paid for sending money from the USA to the Netherlands, and for sending money from the Netherlands to India. This means that

India. Now suppose that the Netherlands has bilateral tax agreements with both the USA and India, and that 10% of taxes has to be paid for sending money from the USA to the Netherlands, and for sending money from the Netherlands to India. This means that  . See the figure below for an overview of the situation.

. See the figure below for an overview of the situation.

If the company send money directly from the USA to India, then a fraction of 0.8 of the profit is left in India. However, if the company would send the profit via the Netherlands, then a fraction of  of the profit is left in India. The example shows that a direct route for sending profits between countries is not always the most profitable route. Companies can use indirect routes to reduce the amount of tax they pay. This is called tax treaty shopping.

of the profit is left in India. The example shows that a direct route for sending profits between countries is not always the most profitable route. Companies can use indirect routes to reduce the amount of tax they pay. This is called tax treaty shopping.

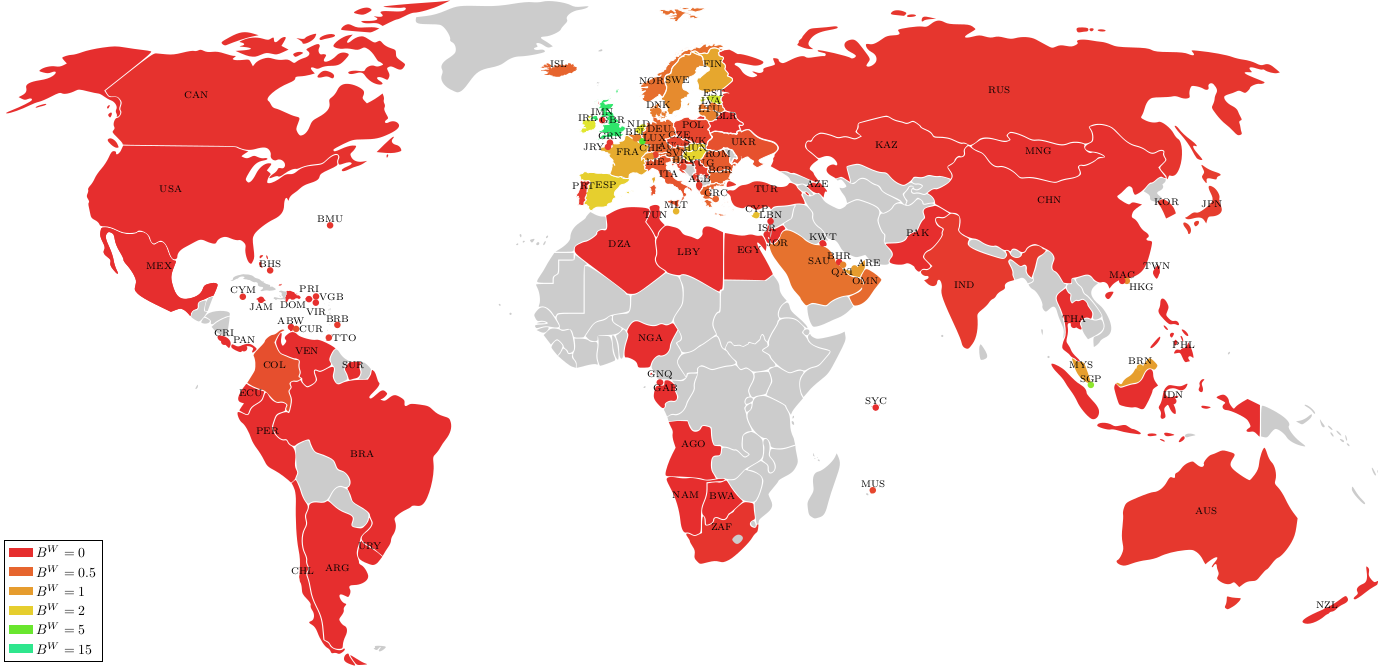

To investigate which countries are the most important conduit countries, a notion for measuring the importance of a country in the network has to be used. One of the measures we have used for this, is the betweenness centrality of a country. Suppose that a company wants to send a profit from the USA to India. Of course, the company will choose to send their profit through a series of countries for which the total taxes it has to pay is as little as possible. In order to see how important the Netherlands is in this process, one can compute the fraction of "optimal tax paths" from the USA to India on which the Netherlands appears. This fraction says something about the importance of the Netherlands for sending profits from the USA to India. The fraction of optimal tax paths on which the Netherlands appears can also be computed for an arbitrary pair of countries in the dataset. The betweenness centrality of the Netherlands is then defined as the sum of these fractions, and therefore says something about its importance in the network for other countries to ship profits through.

Important conduit countries have a higher weighted betweenness centrality (called  ).

).

An extension of the betweenness centrality is the weighted betweenness centrality where certain pairs of countries might be more important than others, which can be modeled by giving the fractions of optimal tax paths more 'weight' than others in the summations of all fractions. Which countries are the most important conduit countries? For the weighted betweenness centrality, the top five is as follows:

- Great Britain

- Luxembourg

- Singapore

- Estonia

- The Netherlands

This shows that the Netherlands plays an important role as conduit country (based on weighted betweenness centrality). Moreover, the research demonstrated that if the Netherlands wanted to improve its role as a conduit country, it must set its outgoing tax rates to India, China and Brazil to zero.

References:

- Sven Polak, Algorithms for the Network Analysis of Bilateral Tax Treaties, Master’s thesis conducted at UvA/CWI/CPB, December 2014.

- Maarten van ’t Riet, Arjan M. Lejour, Optimal Tax Routing: Network Analysis of FDI diversion, CPB Discussion Paper, April 2017.